2024 Irs Schedule 4 – The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .

2024 Irs Schedule 4

Source : ncblpc.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

IRS Tax Refund Calendar 2024: Check expected date to get return

Source : ncblpc.org

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Navigating the IRS Updates: Understanding the 2024 Draft Forms W 4

Source : www.experian.com

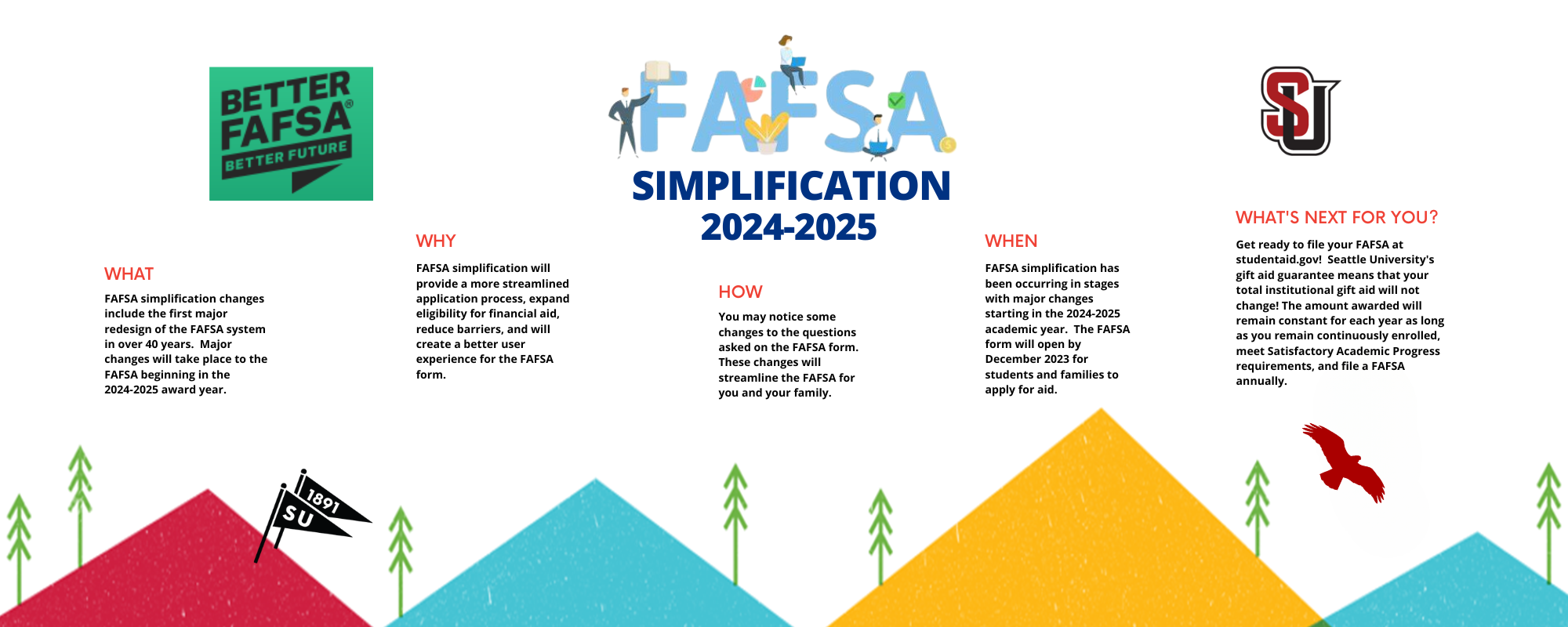

2024 2025 FAFSA Changes | Receiving Financial Aid | Financial Aid

Source : www.seattleu.edu

Key Considerations for 2024 Corporate Tax Planning, Including

Source : www.marcumllp.com

IRS Form 5498: IRA Contribution Information

Source : www.investopedia.com

2024 Irs Schedule 4 IRS Refund Schedule 2024, Tax Return Calendar, e File & on Paper : The IRS on Thursday announced higher inflation adjustments for the 2024 tax year, potentially giving Americans a chance to increase their take-home pay next year. The higher limits for the federal . One place you can start your advance tax planning is with the standard deduction amounts for 2024. Fortunately, the IRS has already released the standard deduction amounts for the 2024 tax year. The .

:max_bytes(150000):strip_icc()/Form5498-135715bd358f41ed99042ea66213b504.png)