2024 Irs Schedule 5 – There are seven tax brackets for most ordinary income for the 2023 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. . The Internal Revenue Service released its annual inflation adjustments Thursday for the 2024 tax year that will boost paychecks and lower income tax for many Americans. .

2024 Irs Schedule 5

Source : www.researchgate.net

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

IRS announces new tax brackets for income taxes

Source : vibes.okdiario.com

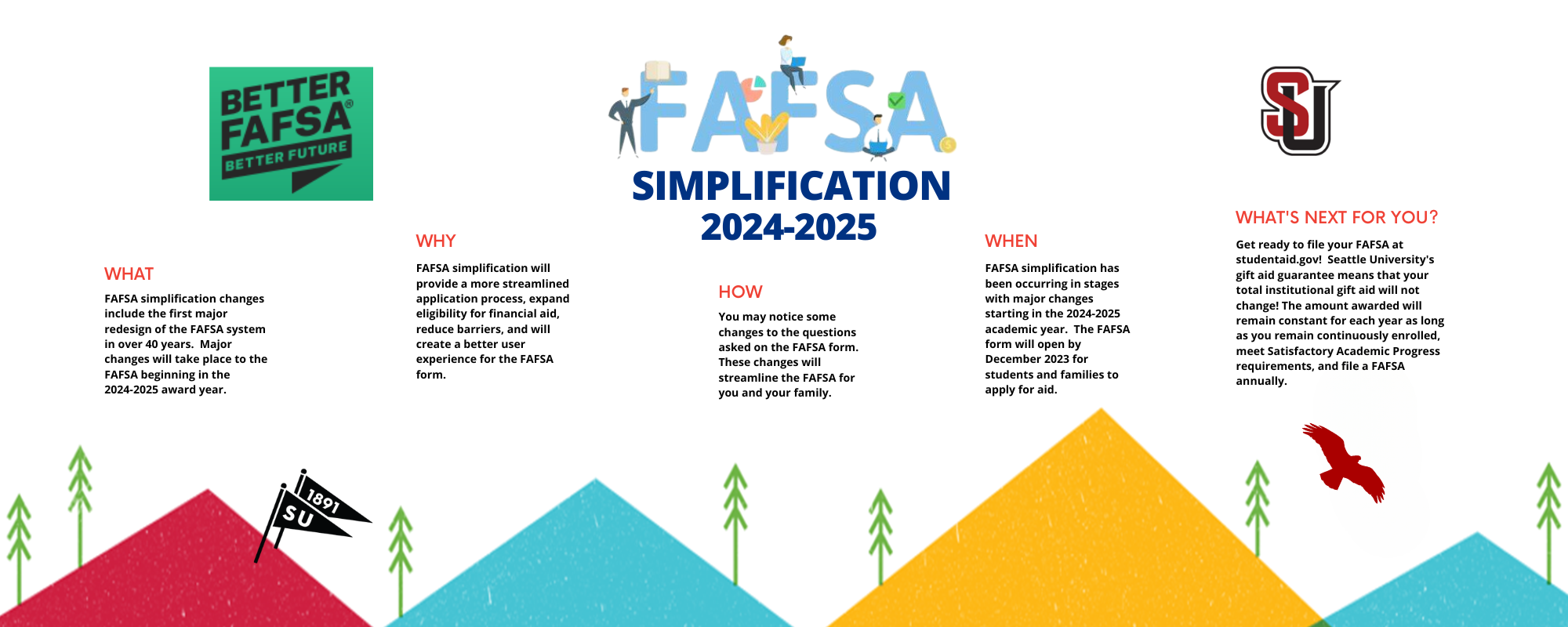

2024 2025 FAFSA Changes | Receiving Financial Aid | Financial Aid

Source : www.seattleu.edu

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

IRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

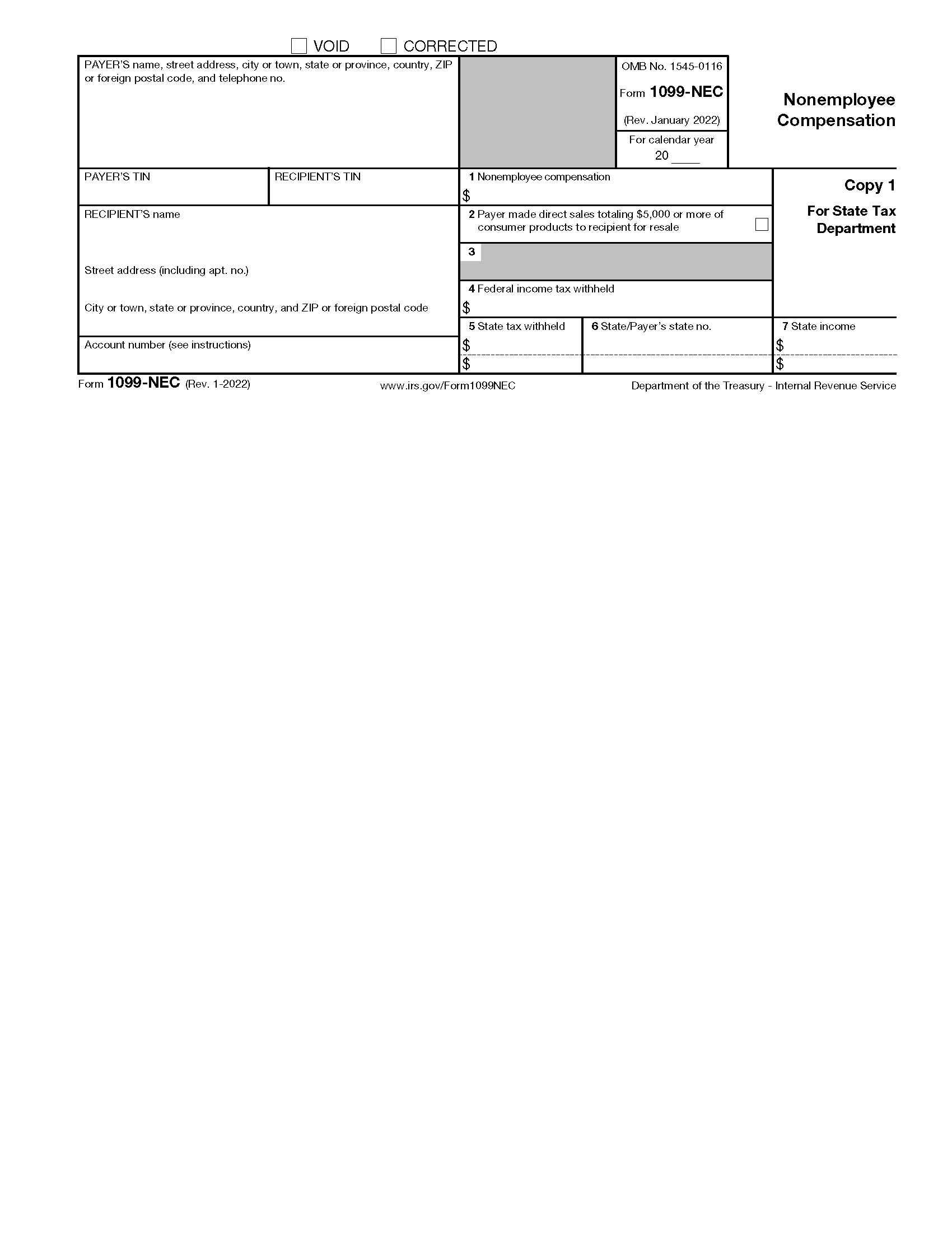

Free IRS 1099 NEC Form (2021 2024) PDF – eForms

Source : eforms.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

Amazon.com: 2024 2028 Monthly Planner/Calendar Jan 2024 Dec

Source : www.amazon.com

2024 Irs Schedule 5 Spectrum of NGC 2024 IRS 1 from 1140 to 1570 Å with overplot of : Some taxpayers may get a break next year on their taxes thanks to the annual inflation adjustment of tax brackets set by the IRS. The tax agency hasn’t yet announced the new brackets for 2024 . The filing deadline for filing federal income tax 2023 is April 15, 2024, and the IRS typically starts accepting tax returns in mid to late January each year. “Remember, filing your taxes early .