Irs 2024 Schedule 4 – The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. . and other popular accounts will be higher in 2024. The IRS, citing the rising cost of living, boosted the annual individual contribution limits for 401(K), 403(b), most 457 plans and the .

Irs 2024 Schedule 4

Source : ncblpc.org

IRS Announces Retirement Plan Limits for 2024 | Vita Companies

Source : www.vitacompanies.com

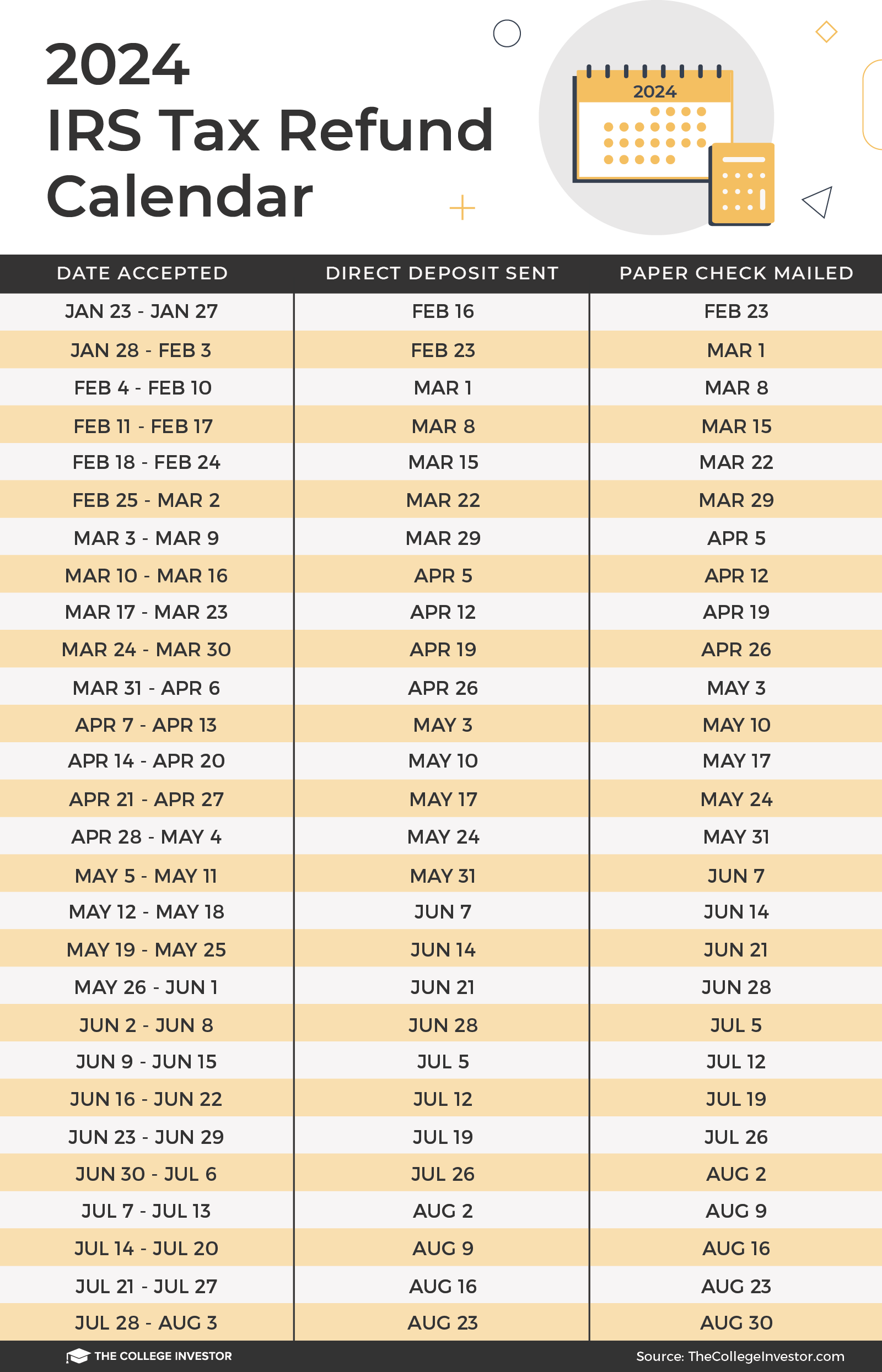

IRS Tax Refund Calendar 2024: Check expected date to get return

Source : ncblpc.org

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

IRS Updates Penalty Amounts For Late Returns, Missed Forms In 2024

Source : www.forbes.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

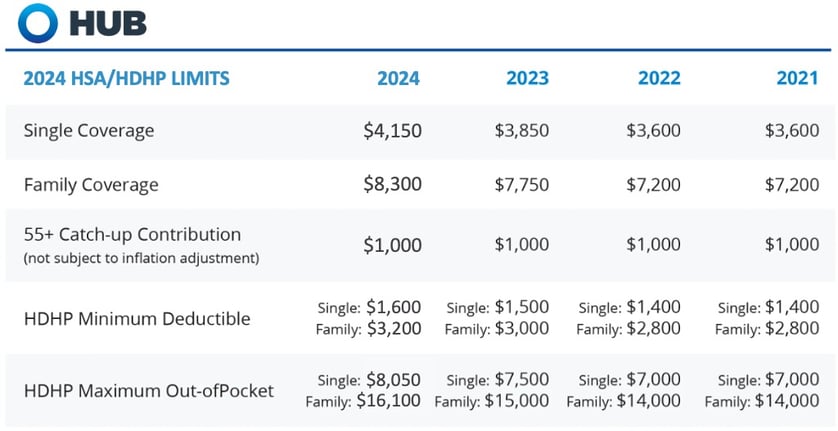

HSA/HDHP Limits Will Increase for 2024

Source : www.griffinbenefits.com

IRS: 401(k), IRA contribution limits for 2024

Source : www.cnbc.com

Key Considerations for 2024 Corporate Tax Planning, Including

Source : www.marcumllp.com

New 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.com

Irs 2024 Schedule 4 IRS Refund Schedule 2024, Tax Return Calendar, e File & on Paper : Some taxpayers may get a break next year on their taxes thanks to the annual inflation adjustment of tax brackets set by the IRS. The tax agency hasn’t yet announced the new brackets for 2024 . The IRS says that the amount you can sock away for retirement is going up. In 2024, individuals can contribute up to $23,000 to their 401(k) plans in 2024—up from $22,500 for 2023. And those .